What it Will Take for You to be Financially Independent?

It all comes down to spending. Your ability to be financially…

September 26, 2019/by Brad RosleyWhy Retirement is a Dumb Goal

Why retirement is a dumb goal.

September 17, 2019/by Brad RosleySecret to a More Peaceful & Happy Life

We've all heard the phrase" chill out". According to Webster,…

August 26, 2019/by Brad RosleyTime to Make a Difference

I've talked to many people about giving a little of what they…

July 30, 2019/by Brad RosleyIdeal 4 Point Retirement Plan

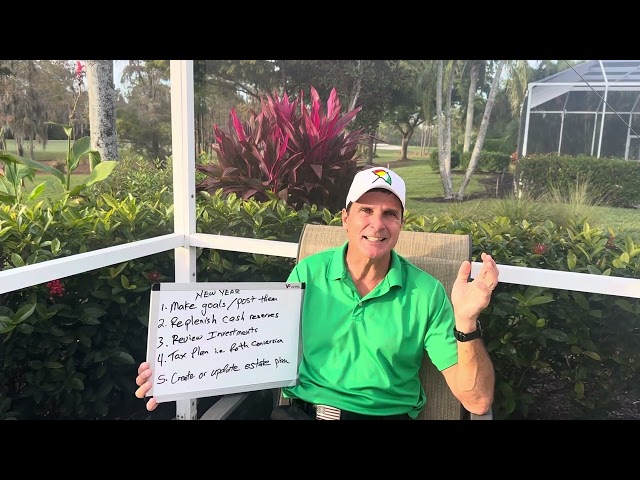

Do you like my 4 point plan?

This plan is a framework…

Better Alternative to Long-Term Care Insurance

This is the vehicle I use to project my money from potential…

June 24, 2019/by Brad RosleyAre Your Mutual Funds Worth the Expense?

One recent analysis saved a widow about $24,000 per year in…

June 17, 2019/by Brad RosleyNothing Beats a Block Party for Community Bonding

Block parties are what neighborhood is all about.

This past weekend,…

June 10, 2019/by Brad RosleyThis past weekend,…

Is a Private Pension in Your Future?

With CD's paying next to nothing, we need some creative ideas…

May 30, 2019/by Brad RosleyExpensive Wedding Reception is a Poor Financial Decision

Is an expensive wedding real worth it?

I think spending a fortune…

May 28, 2019/by Brad RosleyI think spending a fortune…

How to Save Big Money on Healthcare

I've been with Medi-Share for several years and it has saved me thousands in premiums.

May 20, 2019/by Brad RosleyNeed a Financial Resource You Can Go To?

Financial advisor with 25+ years serving clients all over USA.

May 14, 2019/by Brad Rosley