Why I Became a Financial Advisor

I became a financial advisor because I love to help people reach…

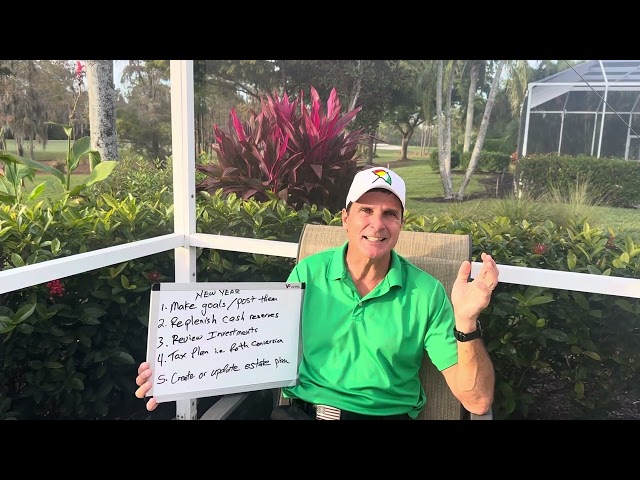

December 22, 2023/by Brad RosleyYear-End Tax Moves to Consider Now

You have some control over how much you pay each year in income…

November 20, 2023/by Brad RosleyIs Your Cell Phone Your Best Friend or Enemy?

It's not just kids who are always on their cell phones or iPad.

Your…

September 18, 2023/by Brad RosleyYour…

Money Markets are Back!

Money Markets are back!

Your bank may not have mentioned that…

April 24, 2023/by Brad RosleyYour bank may not have mentioned that…

U.S. Inflation Crushing Middle Class

Inflation Crushing Middle Class.

Economics 101: More money…

September 14, 2022/by Brad RosleyEconomics 101: More money…

What’s Worse Than Inflation?

Yes, 2 straight quarters of negative GDP (Gross Domestic Product)…

July 28, 2022/by Brad RosleyToday’s Investment Conundrum

Just when you think you’ve seen it all, the US economy and…

June 28, 2022/by Brad RosleyLeading By Example

My wife, Soni, and I pulled the trigger and bought a second home…

February 8, 2022/by Brad RosleyA Christmas Gift for the Ages

Not all Christmas gifts are created equal.

Sure, it’s great…

November 28, 2021/by Brad RosleySure, it’s great…

BIG Tax Benefits of Donor Advised Funds

Time to share my latest personal and client tax-saving and "do-gooder"…

November 3, 2021/by Brad RosleyShould You be Worried?

I am concerned.

It’s only been nine months, but we have…

October 17, 2021/by Brad RosleyIt’s only been nine months, but we have…

Time to Convert Old 401k/IRA to Roth IRA

Thanks to Trump’s Tax Cuts and Jobs of 2017, we have historically…

October 11, 2021/by Brad Rosley